Trade Monitoring

and Code of Ethics

Rule 204A-1 was designed to promote

compliance with fiduciary standards by

RIAs and their personnel.

Trade Monitoring And Code Of Ethics

Rule 204A-1 Was Designed To Promote Compliance With Fiduciary Standards By RIAs And Their Personnel.

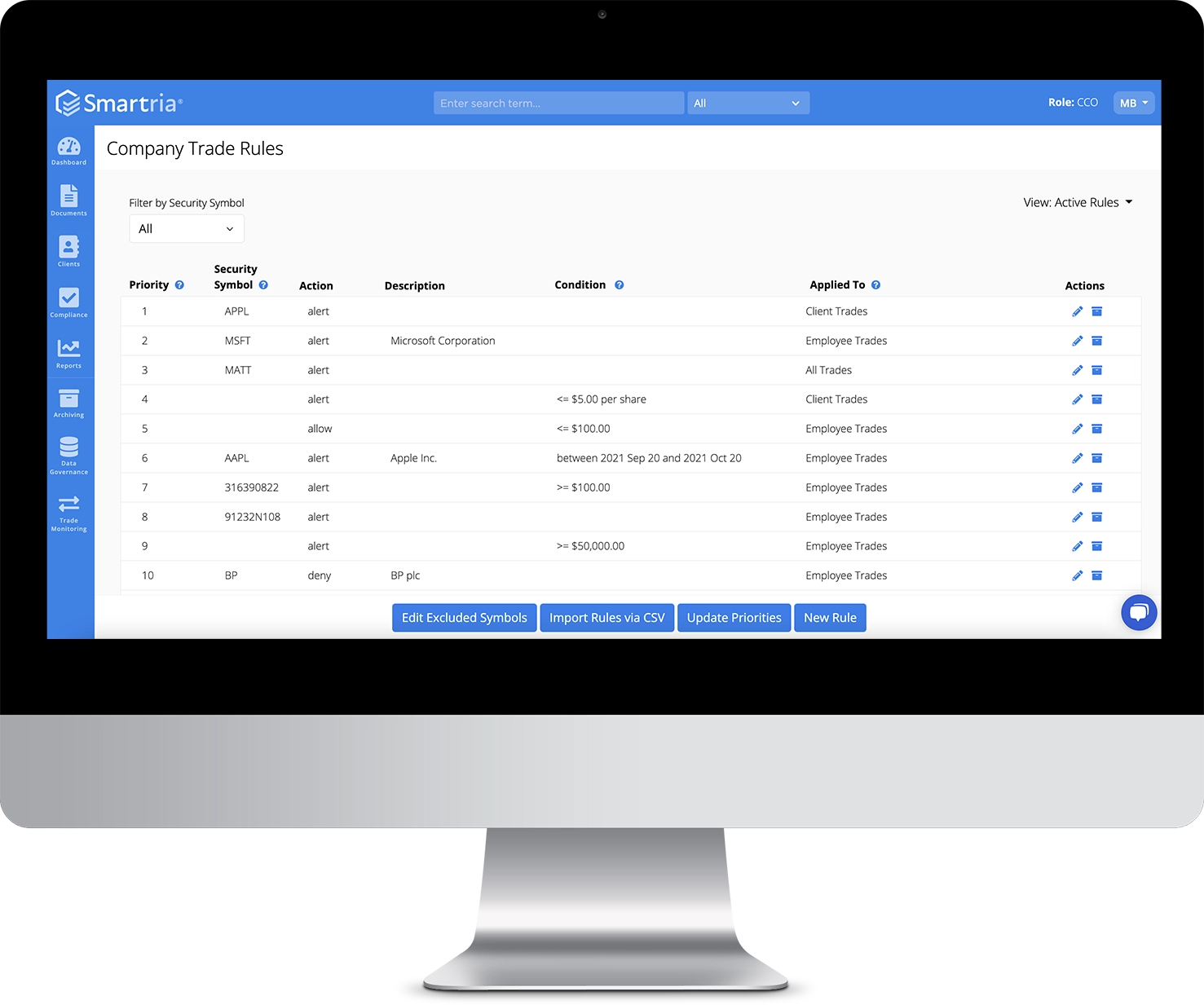

Key components of the rule include Through firm Code of Ethics development, implementation, training and reporting.

Personal Securities Trading Rule 204A-1, the Investment Adviser Code of Ethics Rule, relates to personal securities trading by requiring all access persons of a registered investment adviser (“RIA”) firm to submit securities holdings and transaction reports to the firm’s Chief Compliance Officer (“CCO”) or other designated person(s) to set forth standards of conduct and require compliance with federal securities laws.

Codes of ethics must also address personal trading: they must require advisers’ personnel to report their personal securities holdings and transactions, including those in affiliated mutual funds, and must require personnel to obtain pre-approval of certain investments.