In the early 2000s, SEC exams often meant dusting off physical binders and hunting through emails for attestations. A good compliance officer knew the art of printing PDFs and organizing labeled folders. But that era is over. With its latest release of three granular, data-heavy reports, the SEC isn’t suggesting that firms modernize. It’s modeling what that modernization looks like: in full color, backed by analytics, and mapped over time. It’s exciting, but it can be tricky.

The reports, published by the Division of Economic and Risk Analysis (DERA), dissect Regulation A offerings, equity crowdfunding under the JOBS Act, and beneficial ownership concentration in hedge funds. On the surface, they might seem niche. But taken together, they offer a window into how the SEC is rewriting its own playbook. Data becomes the backbone of risk surveillance.

And for compliance teams still operating with fragmented systems and reactive audits, this shift isn’t theoretical. It’s operational. It affects how policies are implemented, how ownership is documented, and how quickly a firm can respond when a regulator’s model says, Hey, something doesn’t look right.

The SEC’s Data-Driven Turn: A New Regulatory Modus Operandi

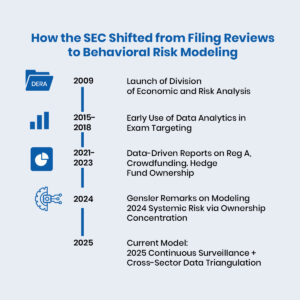

DERA was established in 2009 to bring economic rigor into rulemaking, but in recent years, it has increasingly functioned as the SEC’s in-house analytics unit. Its mandate has matured from economic forecasting to pattern detection and regulatory intelligence.

Take the Regulation A report:

- Of the $3 billion raised through Tier 2 offerings between 2021 and 2023, over 70% went to just ten issuers.

- In the crowdfunding report, most capital flowed to companies with repeat offerings.

- The hedge fund ownership report showed a few beneficial owners hold disproportionately large stakes across multiple funds.

These reports aren’t listing violations. They’re modeling risk. They show a shift from enforcement to early detection, from document review to behavioral inference. And the models aren’t static. They evolve as new data flows in.

As SEC Chair Gary Gensler noted in a speech at Yale in 2022, “Economics and data analytics allow us to better monitor markets, identify emerging risks, and tailor our policy responses accordingly.”

That means firms are no longer being assessed solely by what they disclose, but also by what the data says they’re doing.

Why This Signals a New Kind of Compliance Risk

When oversight is dynamic, compliance must be continuous. Point-in-time reviews—quarterly filings, annual policies, yearly trainings—don’t map easily to an environment where risk models flag issues in real time.

Consider the hedge fund ownership report. It doesn’t accuse any entity of misconduct. Instead, it surfaces correlation clusters: a handful of beneficial owners whose overlapping interests create potential exposure in downturn scenarios. A traditional compliance review might not catch this pattern. But DERA’s models do.

The implication is clear: documentation alone isn’t enough. What matters is the structure and velocity of your data.

Questions firms need to ask:

- Can you track beneficial ownership changes weekly?

- Are your supervisory controls reflecting actual transaction behavior?

- Is your compliance log dynamic or archival?

This shift has cognitive consequences, too. Neuroscience research on pattern recognition (the foundation of expert decision-making) shows that humans identify anomalies best when they see full context, not isolated data points. Regulators are following that playbook. And compliance teams need systems that can do the same.

How Smartria Equips Firms for This New Era

Smarter oversight doesn’t require a crystal ball, but simply a better infrastructure. That’s where Smartria steps in: not as a bolt-on solution, but as a full framework for managing complexity, ownership, and accountability.

1. Centralized Oversight in a Fragmented World

When teams track policies in one tool, attestations in another, and ownership records in a spreadsheet saved to someone’s desktop, oversight suffers. Smartria replaces this sprawl with a unified platform where compliance, supervision, and documentation live in sync.

One mid-sized RIA, for instance, reduced policy retrieval time from four hours to under ten minutes after migrating to Smartria. During their last exam, regulators specifically noted the clarity and coherence of their documentation trail.

2. Time-Sensitive Workflows & Alerts

The SEC’s data isn’t sleeping. Your compliance shouldn’t be, either. Smartria enables workflows that respond to triggers—rule changes, policy deadlines, ownership shifts—and routes them to the right team members. It also logs each step, creating an auditable trail.

With Smartria:

- Deadlines don’t fall through the cracks.

- Every alert has a documented response.

- Teams know exactly what to do and when.

3. Beneficial Ownership Tracking

Most firms treat beneficial ownership as a static table, updated when someone remembers. Smartria treats it as a graph that evolves. It visualizes ownership links, tracks changes over time, and provides exam-ready documentation of who owns what—and when that changed.

This is no longer optional. With the SEC using ownership mapping to flag systemic risk, firms need dynamic records, not quarterly screenshots.

4. Documentation That Thinks Like an Examiner

One of the more subtle ways Smartria creates value is by structuring information the way regulators read it. That means layering evidence, not just storing it. Documents are version-controlled, time-stamped, and tagged by issue area.

Key benefits:

- Fast, structured audit responses

- Clear documentation of approval trails

- Logical connections between policies and outcomes

During a mock exam run for a client, the firm was able to produce a full policy change log—including who approved it and when it was rolled out to staff—in under 60 seconds.

5. Built to Scale

Firms don’t grow in clean increments. New offices, new advisors, and new strategies create complexity quickly. Smartria was built with modularity in mind: permissions, workflow templates, and dashboard visibility can scale with your org chart, without losing control.

That flexibility isn’t just operational. It’s strategic. You don’t need to re-platform every 12 months. You evolve with your compliance system, not around it.

Looking Ahead: Why Compliance Is Becoming a Strategic Asset

As oversight grows more analytical, the smartest firms aren’t asking how to pass exams. They’re asking how to design compliance programs that reduce regulatory friction long-term.

This mindset is already visible in enterprise strategy. A 2024 report by McKinsey found that companies with advanced compliance analytics had:

- Faster M&A close rates

- Fewer post-acquisition write-downs

- Better regulator relationships over time

In public remarks, Gensler has emphasized the agency’s interest in data tools not just to punish, but to “promote resiliency in the market ecosystem”. For firms, this means that compliance is no longer a back-office task. It’s a front-end design decision.

Conclusion: Oversight Has Changed. The Stack Must Follow.

The SEC’s latest reports reveal a new stance: an agency that watches patterns, not just paperwork. For firms that want to stay relevant (and exam-ready) this is the time to modernize.

Smartria helps firms not only meet regulatory expectations but exceed them, by treating compliance as a living, dynamic process. Not an archive. Not an audit trail. A working system.

Data traces tell stories. And the firms who can read those stories in real time, with clarity and confidence, will be the ones who thrive in the years ahead. Try Smartria today and join them.