Introduction: The Real Cost of Scrambling

In 2017, Equifax failed to patch a known vulnerability. As a result, 147 million people had their personal data exposed. It wasn’t a high-tech heist, just an ordinary oversight. The fine was $700 million. It’s a lot. But the cost in public trust was harder to measure.

This wasn’t an isolated event. Across industries, compliance failures (often mundane in origin) regularly spiral into full-blown crisis. The common thread? Systems designed to document the past, not anticipate the future. Compliance, for many enterprises, remains a slow-moving function trying to keep pace with a world that no longer waits.

But the terrain is shifting. Technology is beginning to rewrite what compliance can be. No longer just a defensive shield, it’s becoming a source of agility, resilience, and even strategic insight—for those willing to reimagine it.

Why Enterprise Compliance Is Broken

The list of requirements keeps growing—GDPR, SEC, FINRA, ESG—and each comes with its own set of deadlines, definitions, and disclosure formats. Most compliance teams are still trying to manage it all with spreadsheets, static systems, and a lot of crossed fingers.

Legacy platforms create friction. Information is scattered. Manual processes leave room for error, not because people aren’t careful, but because there are too many moving parts.

And beyond the mechanics, there’s the human toll. Teams operate under pressure, unsure if everything has been captured, logged, or updated. It’s exhausting. According to Deloitte, large firms now spend over $10,000 per employee per year just trying to stay in step.

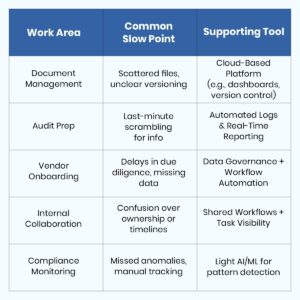

Common Points Where It All Breaks Down:

- Fragmented or delayed access to key data

- Incomplete or unclear audit trails

- Inconsistent, manual reporting

- Tasks that depend on chasing people down instead of clear ownership

The New Tech Stack for Modern Compliance

Think of modern compliance not as a bunker but as a well-organized toolbox. One that finally replaces the duct tape and Post-it notes with something built for the 2020s.

Cloud-Based Platforms

First up: the cloud. Not just for your photos and memes anymore. Cloud-based compliance tools offer real-time monitoring, flexible dashboards, and easy scaling across jurisdictions. Regulators are already asking for this level of readiness, and it’s fast becoming the baseline.

Automated Workflows

Nobody should be manually updating controls at 11pm before a board meeting. Automated workflows cut out the lag, reduce risk, and keep processes moving without five Slack nudges. Many firms now rely on Zapier-style integrations to streamline SOC reporting and certification prep.

Data Governance Tools

These systems—like OneTrust—offer clarity on who owns what and where data lives. They create structure without micromanagement, which makes audits smoother and day-to-day work less ambiguous.

AI and Machine Learning

Sure, it’s not magic, but it’s great at pattern recognition. From flagging shady trades to surfacing KYC risks buried in PDFs, AI lightens the load. JPMorgan’s AI contract review tool reportedly saved 360,000 hours a year—not bad for a robot lawyer.

The Benefits No One Talks About

When compliance works well, something strange happens: people stop being afraid. Teams aren’t bracing for mistakes or second-guessing whether their audit trail is airtight. They start focusing on judgment, on nuance, on work that actually requires a human brain. That shift from fear to clarity is hard to quantify, but it’s what turns compliance from a stressor into a stabilizer.

- Less Cognitive Load

People stop worrying about whether something was forgotten. The basics are covered, and energy goes into decisions, not double-checking. - Stronger Collaboration

With better tools, there’s less back-and-forth and more shared understanding. Teams work together earlier in the process, not just at the final approval stage. - Consistent Readiness

Audits become a regular event, not a fire drill. Documentation is already in place. People know where things are. The whole process becomes… normal. Normal is good. - Faster Time to Trust

Whether onboarding a new partner or expanding into a new market, firms with reliable systems can prove readiness faster. “Time-to-trust” is becoming a real operational metric. - A Healthier Culture

Simple, really: when the pressure is lower and the tools make sense, teams are more confident, less reactive, and more focused on doing meaningful work.

Where Compliance Slows Down vs. What Tech Can Solve

Smartria in Action

Smartria was built by people who’ve been in your shoes. Who knows what it’s like to manage compliance under pressure, with limited time and too many moving parts? It’s not a tool nor a software, but rather a system that’s designed to make your job easier, cleaner, and less stressful.

Here’s what that looks like in practice:

- Clear workflows that help everyone know what’s next

- Centralized documentation that’s already audit-ready

- Human-centered UX—easy to learn and follow

- Streamlined onboarding for new team members and third parties

- Unified information that replaces scattered files and emails

- Support from real people who understand the work and are here to help

Smartria is a system you can lean on. Not to make compliance perfect, but to make it manageable, sustainable, and actually useful.

What’s Next in Compliance Tech

Compliance tools are becoming more predictive. Some are already surfacing risks before they show up in reports. ESG tech is moving into the mainstream, helping firms track and report on sustainability and governance efforts with the same precision as financial metrics.

AI is starting to assist in background tasks—flagging patterns, helping with document review, and offering context for decisions. Oversight is becoming more dynamic, with more visibility and fewer silos.

As the SEC put it in its 2024 digital-first compliance guidance, “Regulatory expectations are shifting toward systems that demonstrate real-time visibility and accountability.”

The direction is clear: deeper insight, cleaner data, and systems that keep up. And once they are done keeping up, they anticipate.

Conclusion

Compliance is part of how a company builds trust, manages complexity, and grows with confidence. It works best when supported by tools that fit into everyday work, reduce friction, and help people stay clear on what matters.

It’s a living system: something that evolves, connects, and supports real people doing real work.

Take a look at your current setup. Where are things slow, messy, or overly manual? That’s where the opportunity is. Try Smartria today.